An In-Depth Examination of the Quick Service Restaurant (QSR) Sector: Market Trends and Major Challenges

Stay informed with industry news, tips, and practical guides for hospitality professionals.

The Quick Service Restaurant (QSR) industry has long been a pillar of the global food service sector, characterised by its fast service, affordable pricing, and convenience. This industry includes everything from burger joints and fried chicken chains to sandwich shops and coffee bars. Over the years, QSRs have evolved, responding to shifting consumer preferences, technology advances, and economic pressures. In this blog, we will delve into the current state of the QSR industry, exploring the latest market trends and the key challenges that operators face in today’s competitive landscape.

Market Trends in the QSR Industry

- Health-Conscious Menus In recent years, there has been a marked shift towards healthier eating, driven by increasing consumer awareness of the impact of diet on overall health. Many QSR chains have responded by offering plant-based options, reducing sodium and sugar content, and providing clearer nutritional information. Vegan and vegetarian options, gluten-free meals, and low-calorie alternatives are becoming standard offerings across many QSR menus. For instance, major brands like McDonald’s and KFC have rolled out plant-based burgers and nuggets, catering to the growing demand for meatless options.

- Technological Advancements and Digital Ordering Technology has transformed the QSR sector in recent years, particularly in how consumers place orders. Digital ordering via mobile apps, online platforms, and self-service kiosks has become widespread. This not only improves the customer experience by reducing wait times but also allows businesses to collect valuable data about customer preferences. Delivery platforms such as UberEats, Deliveroo, and Just Eat have also bolstered QSR sales, making it easier for consumers to access their favourite fast food from the comfort of their homes.

- The integration of Artificial Intelligence (AI) and machine learning in QSR operations is also growing. From predictive analytics for demand forecasting to AI-powered chatbots for customer service, these innovations are helping QSRs enhance operational efficiency and customer satisfaction.

- Sustainability and Ethical Practices Sustainability is a growing concern among consumers, and many QSRs are recognising the importance of adopting more environmentally-friendly practices. Whether it's reducing food waste, sourcing sustainable ingredients, or reducing plastic use, QSRs are increasingly focused on environmental stewardship. Brands are also responding to ethical consumerism by ensuring that their supply chains are transparent and that their products are sourced responsibly. For example, companies are increasingly focusing on sourcing sustainable palm oil or offering recyclable packaging.

- Delivery-First Models The Covid-19 pandemic accelerated the shift towards delivery-first models, and this trend remains significant. Many QSRs, particularly those in urban areas, are focusing on enhancing their delivery offerings, with some even restructuring their operations to prioritise delivery and takeout over in-house dining. This has led to the rise of virtual kitchens or "dark kitchens," which operate solely to fulfil delivery orders, reducing overhead costs and improving delivery times.

- Customisation and Personalisation Consumers today expect more personalised dining experiences. Many QSRs are offering customisation options, allowing customers to tailor their meals according to individual preferences. Whether it's selecting toppings, sauces, or choosing specific ingredients, customisation is becoming a key aspect of the QSR experience. Additionally, many brands are leveraging customer data to offer personalised promotions and rewards, creating loyalty programmes that drive repeat business.

Key Challenges in the QSR Industry

- Labour Shortages One of the most pressing issues for QSRs, particularly in the UK and other Western markets, is the ongoing labour shortage. The industry relies heavily on low-wage, entry-level workers, but the pandemic and subsequent shifts in the workforce have made it more difficult to attract and retain staff. In the UK, the hospitality industry, including QSRs, has faced challenges in filling positions due to the rising cost of living, Brexit-related immigration restrictions, and changing worker expectations. As a result, many QSR operators are increasing wages, offering better benefits, or investing in automation to address staffing shortages.

- Intense Competition The QSR industry is highly competitive, with numerous brands vying for market share. From established giants like McDonald’s and Burger King to smaller, regional players, the competition for customers is fierce. In addition to traditional fast-food chains, QSRs are increasingly facing competition from fast-casual restaurants and delivery-only food businesses. To stand out in such a crowded market, QSRs must continuously innovate their menus, improve customer service, and find new ways to engage with their audience.

- Rising Food and Labour Costs The price of ingredients, as well as the cost of labour, has been rising, squeezing profit margins for many QSR operators. Global supply chain disruptions, inflation, and labour shortages are exacerbating these challenges. To maintain profitability while keeping prices attractive to consumers, QSRs must find creative solutions to manage costs without sacrificing quality or customer experience. Many operators are turning to automation, sourcing more cost-effective ingredients, or reevaluating their pricing strategies to mitigate the impact of these rising costs.

- Health and Safety Regulations Health and safety regulations, especially in the wake of the Covid-19 pandemic, have added an additional layer of complexity for QSR operators. Restaurants must adhere to strict hygiene and safety guidelines, including social distancing measures, sanitation procedures, and ensuring the safety of food delivery services. Compliance with these regulations requires investment in both infrastructure and training, which can be costly for smaller operators.

- Consumer Expectations for Speed and Convenience Consumers expect fast and efficient service, which places pressure on QSRs to optimise their operations. Whether it’s through improving drive-thru times, minimising wait times for in-store orders, or enhancing delivery efficiency, QSRs must balance speed with quality. Customers are increasingly expecting seamless service, both in-store and online, and any delays or mistakes can result in dissatisfaction and lost business. Adapting to changing consumer behaviour, especially in an increasingly digital world, requires QSRs to invest in technology, staff training, and operational improvements.

Conclusion

The Quick Service Restaurant industry continues to evolve as it adapts to shifting market dynamics and consumer demands. Trends such as health-conscious menus, technological integration, sustainability, and delivery-first models are reshaping the way QSRs operate and engage with their customers. However, the industry also faces significant challenges, including labour shortages, rising costs, and intense competition. To remain competitive, QSRs must stay agile, innovate continuously, and focus on improving the customer experience, all while navigating these ongoing hurdles. The ability to adapt to these trends and challenges will determine the future success of QSR brands in an increasingly dynamic marketplace.

Ready to simplify hospitality ops?

We’ve got you.

Speak with an Opsyte expert to see how we help:

- Save hours on staff scheduling and rota planning

- Automate invoice processing and financial insights

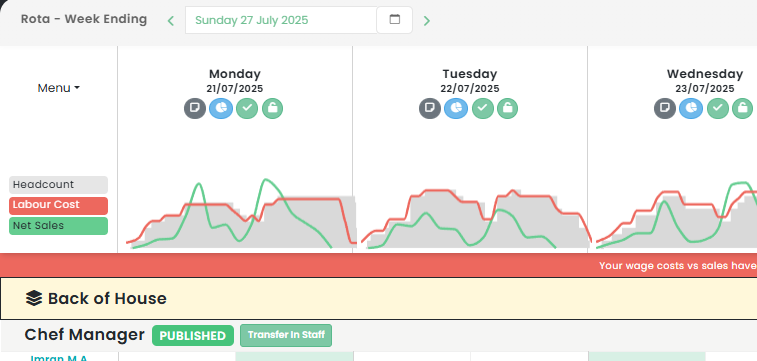

- Track live labour costs vs sales in real-time

- Get fast answers and support from real humans

- Automate your P&Ls

“Opsyte transformed our entire back office. Game changer.”

Read articles from our hospitality experts

-

Boost Your Nightlife Business: Innovative Strategies and Effective Tactics for Nightclub Promotion and Marketing in the Hospitality Industry

Promoting Nightclub Ideas: Innovative Strategies for the UK Hospitality IndustryAs the UK hospitality industry continues to evolve, the need for effective nightclub promotion and marketing strategies becomes increasingly crucial. The…...

-

Strategic Bar Marketing: Increasing Bar Sales through Mixology Marketing, Happy Hour Campaigns, and Social Media Promotion in the Hospitality Industry

Effective Strategies for Bar Marketing in the UK Hospitality IndustryIn the highly competitive UK hospitality industry, strategic bar marketing is a critical component for success. The importance of hotel bar…...

-

Leveraging Pub Marketing Ideas: A Comprehensive Guide to Bar Marketing Strategy, Local Pub Advertising, and Digital Marketing for Pubs in the Hospitality SEO Landscape

Pub Marketing Ideas: Elevating Your Hospitality Business through Effective SEOIn the ever-evolving landscape of the UK hospitality industry, finding innovative and effective pub marketing ideas is essential for success. Understanding…...

-

Unveiling Profitability: An Extensive Analysis of Ratio Averages in the Restaurant Industry and Their Impact on Hospitality and Food Services Business Metrics

Understanding Restaurant Industry Ratio Averages in the UK Hospitality SectorThe hospitality industry, specifically the restaurant business, is a dynamic and competitive sector. The UK has a vibrant hospitality industry, with…...

-

Unveiling the Secrets to Successful Restaurant Business: Understanding Average Profit Margins and Boosting Restaurant Revenue

What is the Average Profit Margin for Restaurants?Understanding the average profit margin for restaurants is vital for anyone involved in the restaurant business. It provides a clear picture of the…...

-

Mastering the Art of Dining: Comprehensive Strategies to Improve Your Restaurant - From Management to Customer Service, Marketing and Beyond

How to Improve Your Restaurant: A Comprehensive GuideIn the highly competitive hospitality industry, improving your restaurant takes more than just a passion for food. It involves a careful balance of…...