The Best Solution to Prevent Cash Discrepancies with Automated Cash-Up Systems

Stay informed with industry news, tips, and practical guides for hospitality professionals.

In the hospitality industry, managing cash flow is critical for maintaining financial integrity and preventing discrepancies that can lead to costly errors. Whether you run a hotel, restaurant, or any other type of hospitality business, handling cash efficiently and accurately is essential for operational success. One of the most effective ways to eliminate cash discrepancies is by using automated cash-up systems.

Why Cash Discrepancies Happen

Cash discrepancies can arise for several reasons:

- Human Error: Manual calculations, miscounting, or incorrect entries are common causes of cash discrepancies.

- Theft or Fraud: Employees may intentionally misreport cash figures, resulting in discrepancies that could go unnoticed.

- Lack of Training: Without standardized procedures and adequate training, mistakes in the cash-up process can lead to discrepancies.

- Time-Consuming Manual Processes: The longer the process takes, the higher the likelihood of errors. Manual processes are often inefficient and prone to oversight.

The solution to these challenges? Automation.

The Role of Automated Cash-Up Systems

Automated cash-up systems streamline the entire cash handling process. By automating the collection, reporting, and reconciliation of cash data, these systems significantly reduce human error and increase the accuracy of daily financial reporting.

Here’s how automated systems can help prevent cash discrepancies:

- Real-Time Monitoring

- Automated systems provide real-time updates on cash flow, allowing managers to track the status of cash-up across different venues instantly. This means any discrepancies are immediately flagged, reducing the risk of unreported issues.

- Automated Data Entry

- With manual processes, staff may mis-enter cash amounts, especially when working under pressure. Automated systems eliminate this risk by automatically recording all financial transactions in the system, ensuring accuracy in every cash count.

- Audit Trails for Transparency

- One of the most important features of automated systems is the ability to generate detailed audit trails. These logs track who handled the cash, what actions were taken, and when discrepancies occurred. This level of transparency makes it easier to identify where the issue originated, whether it’s human error, system glitches, or theft.

- Standardised Processes

- Automated systems follow pre-defined protocols for cash-up and reporting. This ensures consistency across departments, reducing the likelihood of mistakes caused by different interpretations of cash-up procedures. Standardisation leads to better accuracy and fewer discrepancies.

- Built-in Reconciliation Features

- Automated cash-up systems can instantly compare the expected cash count with the actual count. This immediate reconciliation helps detect discrepancies in real time, enabling quick resolution before any significant problems arise.

Preventing Cash Discrepancies

Opsyte, a leading hospitality software platform, stands out as the best solution for eliminating cash discrepancies in your business. Here’s why:

1. Seamless Integration

- Opsyte integrates smoothly with your existing point-of-sale (POS) systems, property management systems (PMS), and accounting software. This means that all transaction data is automatically collected and recorded across touchpoints, ensuring consistent and accurate cash-up reports.

2. User-Friendly Interface

- Opsyte’s interface is designed to be intuitive, making it easy for staff to use, even if they are not tech-savvy. With minimal training, your team can efficiently manage cash-ups, reducing the likelihood of mistakes and improving overall cash handling.

3. Customisable Cash-Up Features

- Opsyte’s system is fully customisable to fit the unique needs of your hospitality business. Whether you’re running a hotel, a restaurant, or a bar, you can tailor cash-up procedures to suit your specific operations, ensuring that your reporting is as accurate and comprehensive as possible.

4. Real-Time Data and Reporting

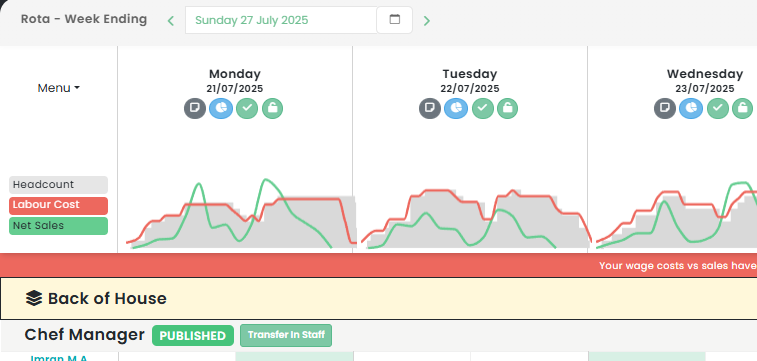

- Opsyte provides real-time cash reporting, which means managers can instantly see if the cash count aligns with expected amounts. Any discrepancies are flagged immediately, helping businesses respond promptly and preventing potential losses. This level of oversight also facilitates better financial planning and forecasting.

5. Built-in Security Features

- Security is a top priority for Opsyte. The platform includes advanced encryption protocols, role-based access controls, and multi-layered authentication to safeguard sensitive financial data. These features not only prevent fraud but also provide an additional layer of accountability across your business.

6. Automated Cash Reconciliation

- Opsyte’s automated reconciliation process ensures that your cash count is compared against expected totals in real time. If any discrepancies are found, the system generates alerts, helping you address issues immediately, rather than waiting until the end of the day or week.

The Bottom Line: Why Opsyte Is a Game-Changer for Your Business

Cash discrepancies can be a major headache for hospitality businesses, leading to lost revenue, damaged reputations, and inefficient operations. However, with automated cash-up systems like Opsyte, you can eliminate these risks, streamline your cash management processes, and gain better control over your finances.

By providing real-time monitoring, detailed audit trails, automated reconciliation, and seamless integration with your existing systems, Opsyte helps hospitality businesses prevent cash discrepancies, increase operational efficiency, and ensure financial transparency.

Investing in Opsyte means investing in the long-term success and security of your business. With Opsyte, you can rest easy knowing that your cash handling and reporting are in good hands—safe, secure, and efficient.

Start using Opsyte today and see how our automated cash-up solution can improve your business!

Ready to simplify hospitality ops?

We’ve got you.

Speak with an Opsyte expert to see how we help:

- Save hours on staff scheduling and rota planning

- Automate invoice processing and financial insights

- Track live labour costs vs sales in real-time

- Get fast answers and support from real humans

- Automate your P&Ls

“Opsyte transformed our entire back office. Game changer.”

Read articles from our hospitality experts

-

Boosting Restaurant Productivity: Discover the Best Scheduling Apps and Management Software for the Hospitality Industry

Best Scheduling App for Restaurants: Improving Efficiency in the UK Hospitality IndustryAs we venture deeper into the digital age, the need for efficient and reliable restaurant management software has become…...

-

Maximising Workforce Efficiency: The Ultimate Guide to Rota Software and Shift Planning in Hospitality Management

Revolutionising the Hospitality Industry with Rota SoftwareThe hospitality industry in the UK is a bustling, dynamic environment. To maintain a smooth operation, efficient scheduling solutions, like Rota Software, have become…...

-

Leveraging Hospitality App Development: The Future of Hotel and Restaurant Management in the Mobile Era

Hospitality App Development: A Game Changer for UK Hospitality IndustryIn the dynamic digital landscape, the hospitality industry is continually evolving, and the demand for innovative technology solutions, particularly mobile apps,…...

-

Boosting Employee Satisfaction: The Impact of Implementing a Living Wage in the Hospitality Industry

The Impact of the Living Wage on the UK Hospitality IndustryThe UK hospitality industry has been at the forefront of numerous discussions on wage standards, compensation, and labor rights. One…...

-

Boost Your Bar Sales: Creative Drink Promotions and Marketing Ideas for the Hospitality Industry

Revitalising Hospitality: Innovative Drink Promotions Ideas for SuccessThe UK hospitality sector, with its vibrant nightlife, lively pubs, and eclectic restaurants, thrives on creativity and innovation. One key to success in…...

-

Boost Your Bar Business: Innovative Marketing Strategies and Promotion Ideas for the Hospitality Industry

Revolutionising Bar Marketing: Innovative Strategies to Boost Your BusinessIn the bustling landscape of the UK hospitality industry, staying ahead of the competition is pivotal. One sector where this rings particularly…...