Essential Statistics and Insights for Understanding the QSR Market

Stay informed with industry news, tips, and practical guides for hospitality professionals.

The Quick Service Restaurant (QSR) industry is one of the most dynamic and competitive sectors in the global foodservice market. With its focus on speed, convenience, and affordability, the QSR sector has grown exponentially, adapting to changing consumer preferences and technological advancements. Understanding key statistics and data points within the QSR market is crucial for operators, investors, and industry stakeholders to make informed decisions.

In this blog, we’ll explore essential statistics that provide a comprehensive overview of the QSR market, offering valuable insights into trends, performance, and future opportunities.

Market Size and Growth

The global QSR industry has experienced robust growth in recent years, and this trend is expected to continue in the coming years.

- Global Market Size: The global QSR market was valued at approximately £260 billion in 2022 and is projected to reach £370 billion by 2028, growing at a compound annual growth rate (CAGR) of around 6.4% during the forecast period.

- Regional Growth: North America, particularly the United States, remains the largest QSR market, accounting for nearly 50% of global QSR revenue. However, significant growth is occurring in emerging markets in Asia-Pacific, Latin America, and Africa, where the demand for fast food continues to rise.

Consumer Trends and Preferences

Understanding the evolving preferences of consumers is key to adapting QSR offerings and ensuring continued success in a competitive market.

- Health-Conscious Eating: Consumers are increasingly demanding healthier options in the QSR sector. Around 62% of consumers now prefer restaurants that offer healthy or nutritious menu items. As a result, QSRs have introduced low-calorie, plant-based, and gluten-free options to cater to this growing demand.

- Online Ordering and Delivery: Digital ordering has become a significant revenue driver for QSRs. In the UK alone, 40% of fast food purchases are made through delivery platforms or mobile apps. This trend has been accelerated by the pandemic and shows no sign of slowing down.

- Sustainability Focus: Approximately 70% of consumers are willing to pay a premium for sustainably sourced food. As sustainability becomes a key concern, QSR brands are introducing more eco-friendly packaging, reducing food waste, and sourcing ingredients responsibly to appeal to environmentally conscious consumers.

Key Market Players

The QSR sector is highly competitive, with a few dominant players controlling a significant share of the market.

- McDonald’s: As the largest QSR chain globally, McDonald's operates more than 39,000 outlets across 120+ countries. The brand's annual revenue surpasses £22 billion.

- Subway: With more than 41,000 stores worldwide, Subway remains one of the largest fast-food chains by number of outlets. In 2022, Subway's global revenue was estimated to be around £9 billion.

- Starbucks: The coffeehouse chain Starbucks operates over 32,000 locations globally. While Starbucks focuses on beverages, it also offers quick meals and snacks, positioning itself as a key player in the broader QSR market.

Profit Margins and Operational Efficiency

Profit margins in the QSR industry tend to be slimmer than in other industries, but with proper management, operators can achieve strong returns.

- Average Profit Margin: The average profit margin for QSRs is typically between 3% and 6%, although this can vary depending on factors such as location, brand strength, and operational efficiency. Well-managed QSRs can achieve higher margins, especially those with strong supply chain management and lower food waste.

- Cost Breakdown: In terms of costs, food typically accounts for 30% to 35% of total revenue, while labour costs are usually around 20% to 30%. Rent and overheads make up a significant portion of expenses, often between 10% and 15%, depending on the location.

Technological Advancements

Technology continues to play a transformative role in the QSR market, from improving customer experiences to streamlining operations.

- Self-Ordering Kiosks: The use of self-ordering kiosks in QSRs has increased significantly in recent years. Around 30% of QSRs globally now incorporate self-service kiosks in their operations, allowing customers to customise orders, reduce wait times, and increase average order value.

- AI and Data Analytics: QSRs are increasingly using Artificial Intelligence (AI) and data analytics to predict customer preferences, manage inventory, and optimise staffing levels. For example, McDonald's has implemented AI-driven systems to forecast demand and improve operational efficiency in real-time.

- Cashless Payments: Cashless transactions have become the norm in the QSR industry. Over 60% of QSR transactions globally are now made via digital payments, including credit and debit cards, mobile wallets, and QR code payments.

Delivery and Takeaway Services

The demand for delivery and takeaway options has surged, especially in light of the COVID-19 pandemic, and it shows no sign of slowing down.

- Market Share: In the UK, the delivery and takeaway market was valued at £6.5 billion in 2022 and is expected to continue growing at a steady pace. Food delivery services, such as Uber Eats, Deliveroo, and Just Eat, have significantly increased the revenue streams for QSRs by providing an additional platform to reach customers.

- Delivery Growth: Research indicates that 70% of QSR customers now expect delivery as an option, with 45% of all QSR transactions in the UK now occurring via delivery apps or services.

- Ghost Kitchens: Delivery-only models, such as ghost kitchens, are also on the rise. These kitchens operate without dine-in spaces, focusing entirely on fulfilling online orders. This model allows QSR brands to expand their reach without the overhead costs of traditional brick-and-mortar locations.

Employee Demographics and Labour Challenges

Labour is a critical factor in the success of QSRs, and the industry faces both challenges and opportunities in terms of employee management.

- Labour Force: The QSR industry employs millions of workers worldwide. In the UK alone, the industry provides jobs for more than 1.5 million people across various roles, including kitchen staff, front-of-house workers, delivery drivers, and managers.

- Wage Pressures: QSRs are facing increasing wage pressures due to labour shortages and rising minimum wage requirements in various markets. In response, many chains are investing in automation, such as self-service kiosks and robotic cooking assistants, to reduce reliance on human labour and improve efficiency.

The Impact of Consumer Behaviour and Trends

Understanding consumer behaviour and preferences is crucial to staying competitive in the QSR market.

- Speed and Convenience: Consumers expect quick service, with nearly 70% of customers choosing QSRs primarily for speed and convenience. Drive-thru services remain a popular choice, accounting for around 60% of QSR sales in the United States.

- Personalisation: Personalised customer experiences, such as customisable menu items or loyalty programs, are increasingly important in attracting and retaining customers. 50% of customers are more likely to return to a QSR that offers personalised recommendations based on past orders or preferences.

Conclusion

The QSR market is vast, dynamic, and rapidly evolving. Key statistics and data points provide valuable insights into the industry's performance, trends, and growth opportunities. From market size and consumer preferences to technological advancements and operational efficiency, understanding these data points is essential for restaurant operators, investors, and stakeholders seeking to navigate the competitive landscape.

By staying informed on key market trends and adapting to changing consumer needs, QSRs can position themselves for success and profitability in a fast-paced, ever-changing market.

Ready to simplify hospitality ops?

We’ve got you.

Speak with an Opsyte expert to see how we help:

- Save hours on staff scheduling and rota planning

- Automate invoice processing and financial insights

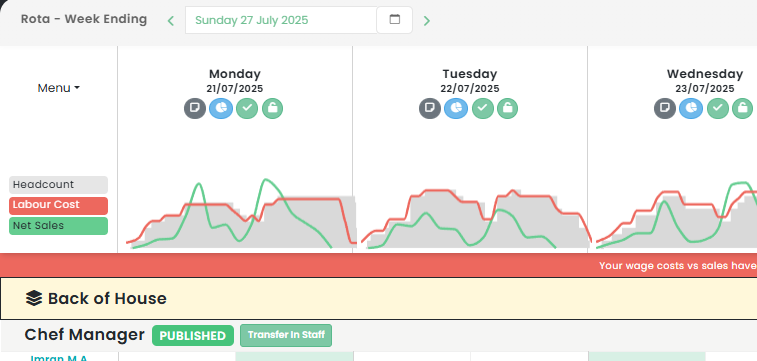

- Track live labour costs vs sales in real-time

- Get fast answers and support from real humans

- Automate your P&Ls

“Opsyte transformed our entire back office. Game changer.”

Read articles from our hospitality experts

-

Maximising Nightlife Entertainment: Innovative Pub Event Ideas and Marketing Strategies for the Hospitality Industry

Revitalise Your Hospitality Business with Creative Pub Event IdeasIn the dynamic and competitive hospitality industry, especially within the sphere of UK pubs, crafting engaging and unique event ideas is crucial…...

-

Boosting Restaurant Productivity: Discover the Best Scheduling Apps and Management Software for the Hospitality Industry

Best Scheduling App for Restaurants: Improving Efficiency in the UK Hospitality IndustryAs we venture deeper into the digital age, the need for efficient and reliable restaurant management software has become…...

-

Maximising Workforce Efficiency: The Ultimate Guide to Rota Software and Shift Planning in Hospitality Management

Revolutionising the Hospitality Industry with Rota SoftwareThe hospitality industry in the UK is a bustling, dynamic environment. To maintain a smooth operation, efficient scheduling solutions, like Rota Software, have become…...

-

Leveraging Hospitality App Development: The Future of Hotel and Restaurant Management in the Mobile Era

Hospitality App Development: A Game Changer for UK Hospitality IndustryIn the dynamic digital landscape, the hospitality industry is continually evolving, and the demand for innovative technology solutions, particularly mobile apps,…...

-

Boosting Employee Satisfaction: The Impact of Implementing a Living Wage in the Hospitality Industry

The Impact of the Living Wage on the UK Hospitality IndustryThe UK hospitality industry has been at the forefront of numerous discussions on wage standards, compensation, and labor rights. One…...

-

Boost Your Bar Sales: Creative Drink Promotions and Marketing Ideas for the Hospitality Industry

Revitalising Hospitality: Innovative Drink Promotions Ideas for SuccessThe UK hospitality sector, with its vibrant nightlife, lively pubs, and eclectic restaurants, thrives on creativity and innovation. One key to success in…...