National Minumum Wage increase - UK 2021

Stay informed with industry news, tips, and practical guides for hospitality professionals.

How to Offset the Cost of Minimum Wage Increases in the UK

The national living wage and minimum wages for those younger than 25 gone up from the 1st of April, which is great news for employees.

For employers, labour costs are one of the largest variable costs that businesses are having to deal with.

Although the wage increases may look small, they quickly add up. As an example, if you are paying the UK Living Wage to 30 staff all over 25 who each work three 8 hour shifts per week, your weekly wage bill will increase by £275 and your yearly bill by £14,000.

We know many of our clients pay their staff more than the national minimum wage, but with the average wage growth (pre COVID in 2018) at 3.4% (ONS link here) all businesses like yours will feel the pressure of increasing wage costs.

There is a way to offset your increased wage costs

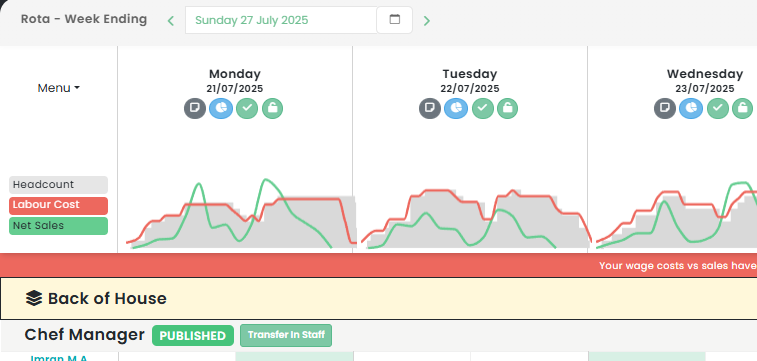

By using Opsyte to manage your T&A (time and attendance, i.e. staff clocking in and out software) our clients tell us the average wage saving is somewhere between 4% and 10%.

With our fixed monthly pricing this means you can be confident you will be saving money by optimising your labour costs whilst paying for a great service.

Using Opsyte you and your staff can manage clock in and out data using smartphones as well as a fixed tablet.

Once clock in and out data is approved by management, the hours worked can be sent directly to your payroll processor.

Ready to simplify hospitality ops?

We’ve got you.

Speak with an Opsyte expert to see how we help:

- Save hours on staff scheduling and rota planning

- Automate invoice processing and financial insights

- Track live labour costs vs sales in real-time

- Get fast answers and support from real humans

- Automate your P&Ls

“Opsyte transformed our entire back office. Game changer.”

Read articles from our hospitality experts

-

Leveraging Hospitality App Development: The Future of Hotel and Restaurant Management in the Mobile Era

Hospitality App Development: A Game Changer for UK Hospitality IndustryIn the dynamic digital landscape, the hospitality industry is continually evolving, and the demand for innovative technology solutions, particularly mobile apps,…...

-

Boosting Employee Satisfaction: The Impact of Implementing a Living Wage in the Hospitality Industry

The Impact of the Living Wage on the UK Hospitality IndustryThe UK hospitality industry has been at the forefront of numerous discussions on wage standards, compensation, and labor rights. One…...

-

Boost Your Bar Sales: Creative Drink Promotions and Marketing Ideas for the Hospitality Industry

Revitalising Hospitality: Innovative Drink Promotions Ideas for SuccessThe UK hospitality sector, with its vibrant nightlife, lively pubs, and eclectic restaurants, thrives on creativity and innovation. One key to success in…...

-

Boost Your Bar Business: Innovative Marketing Strategies and Promotion Ideas for the Hospitality Industry

Revolutionising Bar Marketing: Innovative Strategies to Boost Your BusinessIn the bustling landscape of the UK hospitality industry, staying ahead of the competition is pivotal. One sector where this rings particularly…...

-

Maximising Your Profit Margin: Effective Strategies for Increasing Restaurant Profits and Ensuring Financial Success Through Cost Management and Enhanced Operations

Maximising Restaurant Profitability: Strategies for SuccessIn the competitive UK hospitality sector, the ability to increase restaurant profits and maximise restaurant revenue is a critical determinant of success. Many factors contribute…...

-

Leveraging Restaurant Invoice Software: The Ultimate Guide to Streamlining Your Billing and Management Systems

Optimising Hospitality Operations with Restaurant Invoice SoftwareIn the ever-evolving hospitality industry, the need for efficient and effective management systems is paramount. One of the areas that demands meticulous attention is…...