Payroll changes for 2019-20

Stay informed with industry news, tips, and practical guides for hospitality professionals.

The new payroll year begins on 6 April 2019 and employers should be aware of the changes they will need to make.

Every April the minimum wage and living wage increase so employers will need to ensure that their employees are receiving at least the minimum hourly rate for their age. Employees aged 25 and over must be paid at least the National Living Wage whilst employees aged under 25 must receive at least the National Minimum Wage.

These are the new rates from April 2019.

Age 25 & over Increase to £8.21 per hour Currently £7.83 per hour

Age 21 to 24 Increase to £7.70 per hour Currently £7.38 per hour

Age 18 to 20 Increase to £6.15 per hour Currently £5.90 per hour

Under 18 Increase to £4.35 per hour Currently £4.20 per hour

Apprentice Increase to £3.90 per hour Currently £3.70 per hour

Apprentices can be paid the apprentice rate if they are aged under 19 or if they are 19 and over and in the first year of their apprenticeship. An apprentice who is over 19 and has completed their first year of apprenticeship is entitled to the minimum wage rate for their age.

If you provide your employee with accommodation you can charge them the offset accommodation rate of £7.55 per day for 2019/20. If you charge them more than this amount for their accommodation and only pay them the Minimum Wage rate for their age you will be paying them less than they must be paid.

It is a criminal offence not to pay your employees the National Living Wage or National Minimum Wage.

Statutory payments also increase for 2019-20 and you can see the new rates for Statutory Sick Pay, Statutory Maternity and Paternity Pay, etc here.

Pension Contribution IncreasesAuto enrolment pension contributions for employers and employees will increase from 6 April 2019 with employees contributing a minimum of 5% of their qualifying earnings each month and employers contributing 3% giving a total pension contribution of 8%.

If you are already paying above the current minimum rate of 2% for employers you must ensure the amount you are paying will reach the mandatory 3% of qualifying earnings when the change comes into effect in April.

As an employer you will may need to make a few calculations before the start of the next payroll year:

Check the current hourly pay rate for each of your employees to ensure they are being paid the correct rate for their age and that it will meet the new hourly pay rate for their age.

Check whether the current pension contribution you are making (if more than the mandatory 2%) is sufficient to cover the new mandatory rate of 3% of qualifying earnings.

As we come to the end of the payroll year 2018-19 it is worth checking with your employees that the details shown on their payslip are correct - we suggest checking their name and address (either of which may have changed during the year) and their National Insurance number in case it has been incorrectly recorded. Any changes to information can then be submitted to HMRC as part of the final submission for the year and will ensure their P60 information is correct.

Ready to simplify hospitality ops?

We’ve got you.

Speak with an Opsyte expert to see how we help:

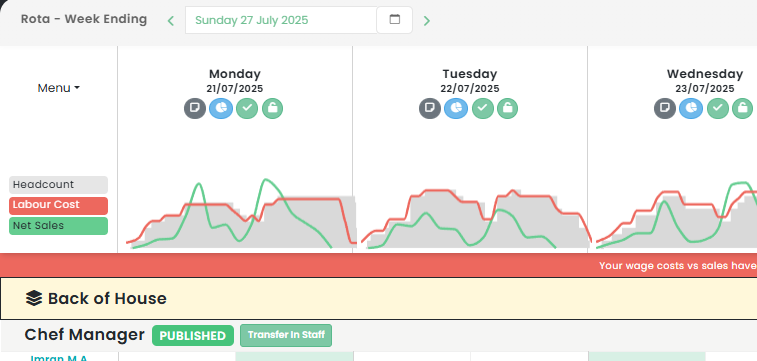

- Save hours on staff scheduling and rota planning

- Automate invoice processing and financial insights

- Track live labour costs vs sales in real-time

- Get fast answers and support from real humans

- Automate your P&Ls

“Opsyte transformed our entire back office. Game changer.”

Read articles from our hospitality experts

-

Maximising Nightlife Entertainment: Innovative Pub Event Ideas and Marketing Strategies for the Hospitality Industry

Revitalise Your Hospitality Business with Creative Pub Event IdeasIn the dynamic and competitive hospitality industry, especially within the sphere of UK pubs, crafting engaging and unique event ideas is crucial…...

-

Boosting Restaurant Productivity: Discover the Best Scheduling Apps and Management Software for the Hospitality Industry

Best Scheduling App for Restaurants: Improving Efficiency in the UK Hospitality IndustryAs we venture deeper into the digital age, the need for efficient and reliable restaurant management software has become…...

-

Maximising Workforce Efficiency: The Ultimate Guide to Rota Software and Shift Planning in Hospitality Management

Revolutionising the Hospitality Industry with Rota SoftwareThe hospitality industry in the UK is a bustling, dynamic environment. To maintain a smooth operation, efficient scheduling solutions, like Rota Software, have become…...

-

Leveraging Hospitality App Development: The Future of Hotel and Restaurant Management in the Mobile Era

Hospitality App Development: A Game Changer for UK Hospitality IndustryIn the dynamic digital landscape, the hospitality industry is continually evolving, and the demand for innovative technology solutions, particularly mobile apps,…...

-

Boosting Employee Satisfaction: The Impact of Implementing a Living Wage in the Hospitality Industry

The Impact of the Living Wage on the UK Hospitality IndustryThe UK hospitality industry has been at the forefront of numerous discussions on wage standards, compensation, and labor rights. One…...

-

Boost Your Bar Sales: Creative Drink Promotions and Marketing Ideas for the Hospitality Industry

Revitalising Hospitality: Innovative Drink Promotions Ideas for SuccessThe UK hospitality sector, with its vibrant nightlife, lively pubs, and eclectic restaurants, thrives on creativity and innovation. One key to success in…...