The Factoring Process: What You Need to Know About Selling Your Receivables

Stay informed with industry news, tips, and practical guides for hospitality professionals.

We’ve said it before, but it’s well worth repeating: cash flow is the lifeblood of every successful business. It’s often a lack of liquidity, in fact – rather than a shortage of sales – that prevents newer companies from growing. One way to keep your business afloat during a cash flow shortfall is to sell your accounts receivable invoices to a factoring company. Factoring doesn’t come free, however. So here’s what you need to know before exploring it further.

What is Factoring?

Factoring is a financing process in which you sell your outstanding customer invoices to a third party known as a factor. While receivables are sold at a discounted price in terms of their face value, factoring can be a feasible way to manage your cash flow over the short term.

And that’s important. Because every client has the potential to run up against financial difficulties that prevent them from paying their bills on time. As a finance management tool, factoring is a proven way to help your business:

span the cash flow gap created by a client’s slow payment habits, and

offset bad debt accounts

If your company has an established sales history, entering into an agreement with a factor will get you the cash that you need. But the price for that assistance includes both interest and financing fees based on the amount of money advanced to your business.

Nuts & Bolts of the Factoring Process

While the exact process varies from company to company, factoring agreements share some basic elements intended to smooth out your business’s cash flow. Here’s how it usually works:

When you work with a factor, you agree to forward copies of all new customer invoices to the factoring company.

In return, the factor advances funds to your business that typically range from 80-85% of each invoice amount.

The remaining 15-20% is held in reserve until payment has been collected in full from your customer.

Once your client pays their outstanding invoice to the factoring company, the reserve funds are released to you – less the agreed-upon financing charges.

Factoring charges usually include a hefty financing fee, and interest on the original 80-85% that was advanced to your business.

Factoring agreements can involve either recourse or nonrecourse financing. In a recourse situation, your business bears financial responsibility for any uncollectible invoice amounts. In a nonrecourse agreement, the factoring company takes charge of collecting from your clients – and assumes the financial burden of any unpaid amounts.

To Factor or Not to Factor

The practice of invoice factoring as we know it today has been around since the 1300s. But thanks to the internet expanding access to bank subsidiaries and other financial institutions offering this service, factoring has become an increasingly popular form of alternative finance. Here’s why:

Small business loans can sometimes be difficult to obtain – especially for companies without a stellar credit history.

Despite the high costs associated with factoring, it can sometimes be more cost-effective than negotiating early payment discounts with your customers.

Rather than (maybe) getting paid just a little bit sooner by offering your clients a discount, factoring gives your business access to cash almost immediately upon providing your service or shipping your product.

Speeding up the payment process gives your business superior benefits in terms of managing your cash flow.

While the factoring process can be expensive, there’s no denying how well it’s stood the test of time. And factoring has grown by 15% in the US since 2004 – suggesting that many companies find it a valuable form of short-term cash financing.

Just the same, you should understand that factoring is not the same thing as a bank loan – especially where costs are concerned. Rates vary widely, but charges often make up anywhere from 2-10% of your credit sales. Most factors will also require access to ALL of your client receivables – not just the ones you deem hard to collect.

One Final Note

While many factoring companies offer a range of A/R services (including collections and credit verification) that can reduce the expense of performing these tasks yourself, there are a handful of businesses that simply won’t qualify, or that shouldn’t consider working with a factoring company.

These include any company that doesn’t engage in credit sales, and fledgling businesses in need of startup capital. In addition, firms with a sound credit rating are usually better off sourcing funds that come with a significantly lower price tag.

Ready to simplify hospitality ops?

We’ve got you.

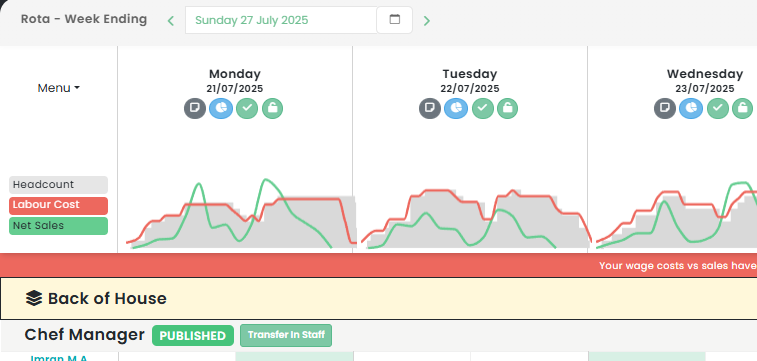

Speak with an Opsyte expert to see how we help:

- Save hours on staff scheduling and rota planning

- Automate invoice processing and financial insights

- Track live labour costs vs sales in real-time

- Get fast answers and support from real humans

- Automate your P&Ls

“Opsyte transformed our entire back office. Game changer.”

Read articles from our hospitality experts

-

Leveraging Hospitality App Development: The Future of Hotel and Restaurant Management in the Mobile Era

Hospitality App Development: A Game Changer for UK Hospitality IndustryIn the dynamic digital landscape, the hospitality industry is continually evolving, and the demand for innovative technology solutions, particularly mobile apps,…...

-

Boosting Employee Satisfaction: The Impact of Implementing a Living Wage in the Hospitality Industry

The Impact of the Living Wage on the UK Hospitality IndustryThe UK hospitality industry has been at the forefront of numerous discussions on wage standards, compensation, and labor rights. One…...

-

Boost Your Bar Sales: Creative Drink Promotions and Marketing Ideas for the Hospitality Industry

Revitalising Hospitality: Innovative Drink Promotions Ideas for SuccessThe UK hospitality sector, with its vibrant nightlife, lively pubs, and eclectic restaurants, thrives on creativity and innovation. One key to success in…...

-

Boost Your Bar Business: Innovative Marketing Strategies and Promotion Ideas for the Hospitality Industry

Revolutionising Bar Marketing: Innovative Strategies to Boost Your BusinessIn the bustling landscape of the UK hospitality industry, staying ahead of the competition is pivotal. One sector where this rings particularly…...

-

Maximising Your Profit Margin: Effective Strategies for Increasing Restaurant Profits and Ensuring Financial Success Through Cost Management and Enhanced Operations

Maximising Restaurant Profitability: Strategies for SuccessIn the competitive UK hospitality sector, the ability to increase restaurant profits and maximise restaurant revenue is a critical determinant of success. Many factors contribute…...

-

Leveraging Restaurant Invoice Software: The Ultimate Guide to Streamlining Your Billing and Management Systems

Optimising Hospitality Operations with Restaurant Invoice SoftwareIn the ever-evolving hospitality industry, the need for efficient and effective management systems is paramount. One of the areas that demands meticulous attention is…...