An Overview of Key Financial Ratios and Metrics in the Restaurant Industry

Stay informed with industry news, tips, and practical guides for hospitality professionals.

The restaurant industry is a dynamic and fast-paced sector where success depends not only on great food and service but also on strong financial management. Understanding and analysing key financial ratios and metrics is crucial for restaurant owners and managers to evaluate performance, identify trends, and make informed decisions that drive profitability and growth.

In this blog, we will explore the most important financial ratios and metrics in the restaurant industry, explaining what they mean, how they’re calculated, and why they matter.

Food Cost Percentage

Food cost percentage is one of the most important financial metrics in the restaurant industry. It measures how much of your revenue is spent on the ingredients needed to prepare your menu items.

Formula:

Food Cost Percentage = (Cost of Food Sold / Total Food Sales) × 100

Why It Matters:

Food cost percentage directly impacts profitability. A high food cost percentage can indicate inefficiencies, such as waste, portion control issues, or overpriced menu items. The average food cost percentage in the restaurant industry typically ranges from 25% to 35%, though it can vary depending on the type of restaurant. For example, fine dining establishments may have a slightly higher food cost percentage, while fast-casual restaurants tend to operate on lower percentages.

What to Aim For:

Aiming for a food cost percentage within the industry average or slightly lower is key to maintaining a healthy profit margin. To achieve this, closely monitor your inventory, implement portion control, and regularly review supplier contracts to ensure you're getting the best value for your money.

Labour Cost Percentage

Labour costs are another significant expense in the restaurant business, typically accounting for a large portion of operating expenses. The labour cost percentage shows the proportion of revenue that is spent on wages, salaries, and benefits for employees.

Formula:

Labour Cost Percentage = (Labour Costs / Total Sales) × 100

Why It Matters:

Managing labour costs is essential to running a profitable restaurant. High labour costs can erode your margins, especially if your sales are inconsistent or if you employ more staff than needed during slow periods. The average labour cost percentage in the restaurant industry is generally 25% to 35%, although it varies depending on the restaurant's concept and location.

What to Aim For:

To optimise labour costs, consider adjusting staffing levels based on forecasted sales, offering cross-training to increase flexibility, and using scheduling software to better manage shifts. Keeping labour costs within industry norms ensures that your restaurant can run efficiently without sacrificing service quality.

Gross Profit Margin

The gross profit margin is a measure of how much money your restaurant makes after covering the cost of goods sold (COGS), which includes food and beverage costs. This ratio is important because it shows how efficiently your restaurant is producing and selling its menu items.

Formula:

Gross Profit Margin = (Revenue - Cost of Goods Sold) / Revenue × 100

Why It Matters:

A healthy gross profit margin indicates that your restaurant is effectively managing food costs and pricing its menu items appropriately. In the restaurant industry, a typical gross profit margin ranges from 60% to 70%. Fine dining establishments may achieve higher margins, while casual dining and quick-service restaurants tend to have lower margins due to their higher food costs and competitive pricing.

What to Aim For:

To increase gross profit margin, focus on reducing food waste, improving portion control, negotiating with suppliers for better prices, and revising menu prices periodically to reflect changes in food costs and customer demand.

Net Profit Margin

Net profit margin is one of the most critical indicators of a restaurant’s overall financial health. It calculates the percentage of revenue that remains as profit after all operating expenses (including food, labour, rent, utilities, marketing, and other overheads) have been deducted.

Formula:

Net Profit Margin = (Net Profit / Total Revenue) × 100

Why It Matters:

This ratio shows the profitability of your restaurant after accounting for all costs. In the restaurant industry, net profit margins are often quite slim, typically ranging from 3% to 10%, depending on factors like the type of restaurant, location, and operational efficiency.

What to Aim For:

While the average net profit margin in the industry may seem low, it’s essential to optimise your operations, control costs, and increase revenue to boost your net profit. Cutting unnecessary expenses, increasing sales through promotions, and improving operational efficiency can help improve your net profit margin.

Average Check Size (Average Ticket Value)

The average check size or ticket value is a key metric for measuring customer spending and can be an excellent tool for assessing the effectiveness of upselling and marketing strategies.

Formula:

Average Check Size = Total Sales / Number of Transactions

Why It Matters:

The average check size gives you insight into customer spending habits. If your average check size is lower than expected, it may suggest that customers are not ordering enough or that upselling techniques are not being effectively employed.

What to Aim For:

Increasing your average check size can be achieved through strategies like upselling, offering premium menu options, creating attractive combos or meal deals, and encouraging customers to add drinks or desserts. By focusing on boosting the average ticket value, you can significantly increase revenue without having to increase foot traffic.

Table Turnover Rate

The table turnover rate is a metric that measures how many times a table is occupied by customers during a specific period, such as a shift or a day.

Formula:

Table Turnover Rate = Number of Customers / Number of Tables

Why It Matters:

A higher table turnover rate indicates that your restaurant is efficiently seating and serving customers, which directly correlates with increased sales and profitability. The average turnover rate varies by restaurant type, but in general, a turnover rate of 1.5 to 2 times per day is considered healthy for casual dining.

What to Aim For:

To increase table turnover without compromising customer experience, consider adjusting seating arrangements, optimising wait times, and training staff to handle peak periods efficiently. However, it’s important to strike a balance—rushing customers or overcrowding tables can harm the overall dining experience.

Occupancy Cost Ratio

The occupancy cost ratio measures the proportion of a restaurant’s revenue that goes towards rent or mortgage, utilities, and other occupancy-related expenses.

Formula:

Occupancy Cost Ratio = (Occupancy Costs / Total Revenue) × 100

Why It Matters:

Rent and occupancy costs are one of the largest fixed expenses for many restaurants. A high occupancy cost ratio can signal that a restaurant is in a location with high rent or is not generating enough revenue to cover its fixed costs. Ideally, occupancy costs should account for no more than 6% to 10% of total revenue, although this can vary depending on location.

What to Aim For:

Managing occupancy costs requires careful negotiation of lease terms, monitoring energy efficiency, and ensuring that revenue is maximised through consistent customer traffic. A restaurant in a prime location may accept higher occupancy costs if it results in greater revenue potential.

Conclusion

In the competitive world of the restaurant industry, understanding and analysing key financial ratios and metrics is essential for maintaining profitability and operational efficiency. By keeping an eye on food costs, labour costs, profit margins, and other key performance indicators, restaurant owners and managers can make more informed decisions that lead to sustainable growth.

While these ratios provide a snapshot of your financial health, it’s important to regularly review and adjust your strategies to align with changing market conditions, customer preferences, and business goals. By doing so, you'll be better equipped to navigate the complexities of the restaurant industry and secure long-term success.

Ready to simplify hospitality ops?

We’ve got you.

Speak with an Opsyte expert to see how we help:

- Save hours on staff scheduling and rota planning

- Automate invoice processing and financial insights

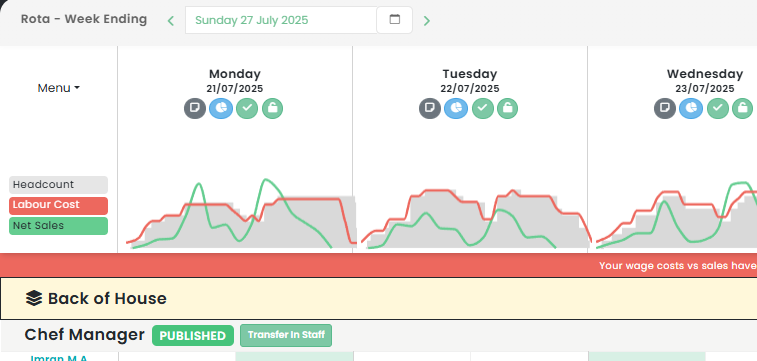

- Track live labour costs vs sales in real-time

- Get fast answers and support from real humans

- Automate your P&Ls

“Opsyte transformed our entire back office. Game changer.”

Read articles from our hospitality experts

-

Leveraging Hospitality App Development: The Future of Hotel and Restaurant Management in the Mobile Era

Hospitality App Development: A Game Changer for UK Hospitality IndustryIn the dynamic digital landscape, the hospitality industry is continually evolving, and the demand for innovative technology solutions, particularly mobile apps,…...

-

Boosting Employee Satisfaction: The Impact of Implementing a Living Wage in the Hospitality Industry

The Impact of the Living Wage on the UK Hospitality IndustryThe UK hospitality industry has been at the forefront of numerous discussions on wage standards, compensation, and labor rights. One…...

-

Boost Your Bar Sales: Creative Drink Promotions and Marketing Ideas for the Hospitality Industry

Revitalising Hospitality: Innovative Drink Promotions Ideas for SuccessThe UK hospitality sector, with its vibrant nightlife, lively pubs, and eclectic restaurants, thrives on creativity and innovation. One key to success in…...

-

Boost Your Bar Business: Innovative Marketing Strategies and Promotion Ideas for the Hospitality Industry

Revolutionising Bar Marketing: Innovative Strategies to Boost Your BusinessIn the bustling landscape of the UK hospitality industry, staying ahead of the competition is pivotal. One sector where this rings particularly…...

-

Maximising Your Profit Margin: Effective Strategies for Increasing Restaurant Profits and Ensuring Financial Success Through Cost Management and Enhanced Operations

Maximising Restaurant Profitability: Strategies for SuccessIn the competitive UK hospitality sector, the ability to increase restaurant profits and maximise restaurant revenue is a critical determinant of success. Many factors contribute…...

-

Leveraging Restaurant Invoice Software: The Ultimate Guide to Streamlining Your Billing and Management Systems

Optimising Hospitality Operations with Restaurant Invoice SoftwareIn the ever-evolving hospitality industry, the need for efficient and effective management systems is paramount. One of the areas that demands meticulous attention is…...