UK MPs Rally for Hospitality: Urgent Calls for Government Support

Stay informed with industry news, tips, and practical guides for hospitality professionals.

Introduction

In a resounding call for bolstered support to the struggling hospitality sector, Members of Parliament from across the United Kingdom have united in their demand for increased backing.

The urgency of this appeal was underscored by a recent debate held in Westminster Hall, focusing on the crucial topic of fiscal support for the hospitality industry. Led by Alyn Smith, the MP for Stirling, the discourse gained momentum as fellow MPs rallied behind the assertion that the hospitality sector requires additional assistance from the UK government.

Smith's impassioned statement during the debate encapsulates the gravity of the situation: "Am I looking for special treatment for the hospitality sector? Yes. I think they need it, and I think they deserve it." ’ (catererlicensee.com)

He emphasized the industry's integral role not only in the economy but also as community hubs contributing to our societal fabric. His sentiments align with UKHospitality's comprehensive three-point plan, unveiled earlier this year, aiming to generate investment through business rates reform, create jobs via Apprenticeship Levy adjustments, and stimulate economic growth through a reduction in the VAT rate.

The resonance of these concerns extends beyond Smith, as multiple MPs echo the sentiments outlined in UKHospitality's plan, specifically targeting the upcoming Budget. Key objectives include ‘[generating] investment through root and branch reform of business rates, create jobs through Apprenticeship Levy reform and drive economic growth through a lower rate of VAT.’ (ukhospitality.org.uk)

As the government prepares for critical fiscal decisions, the collective voice of these MPs and industry advocates seeks to shape policies that will fortify the foundations of the hospitality sector.

The Hospitality Sector's Concerns

In the aftermath of the Westminster debate, the concerns voiced by Kate Nicholls, Chief Executive of UKHospitality, illuminate the profound challenges confronting the hospitality sector. Nicholls succinctly remarked, ‘It’s evident from the debate that MPs recognise the challenges facing the sector and back our calls for urgent action.

There was particular cross-party support to lower the rate of VAT and reform business rates – all priority asks of ours’ (thecaterer.com). This unanimous cross-party backing for the reduction of the VAT rate and the overhaul of business rates echoes the fundamental goals outlined by UKHospitality.

Nicholls' apprehensions about the UK's high 20% VAT rate, especially when juxtaposed with European counterparts, underscore the industry's susceptibility. Her stark observation from last year paints a vivid picture of the economic challenges faced by the sector: ‘[o]ur 20% rate of VAT ranks among the highest in Europe, and the introduction of tourist taxes in Scotland and Wales will further add to the cost of visiting’ (morningadvertiser.co.uk),

Proposing a reduced VAT rate specifically tailored for hospitality, leisure, and tourism, Nicholls advocates for a strategic approach that can invigorate both domestic and international demand, ensuring a sustainable revenue stream.

These sentiments find resonance not only among industry leaders like Sacha Lord, the night-time economic adviser for Greater Manchester, but also among those who operate on the frontline, such as Lord who stated, ‘The 12.5 per cent VAT rate was a lifeline during the pandemic and must be reinstated, […] Ultimately, 12.5 per cent of revenue for the Exchequer is better than 20 per cent of nothing, which will increasingly be the result if the businesses go under’ (thisismoney.co.uk).

As we usher in 2024, UKHospitality's three-point plan, passionately endorsed by Nicholls, positions the sector at the forefront of political discourse. She declared, ‘all political parties to ensure hospitality is at the front and centre of policy making’ (ukhospitality.org.uk).

This comprehensive plan, designed to ‘generate investment through root and branch reform of business rates, create jobs through Apprenticeship Levy reform and drive economic growth through a lower rate of VAT’ (ukhospitality.org.uk), serves as a guiding light for the industry's future.

The optimistic tone emanating from the recent Westminster debate indicates potential alignment with these objectives, setting the stage for the eagerly anticipated tax and spending plans to be unveiled by Jeremy Hunt in the upcoming Spring Budget on March 6, 2024. The industry, buoyed by this collective momentum, remains cautiously optimistic about the prospect of substantive government support.

The Government's Response

Steve Double

Steve Double, the Conservative MP for St Austell and Newquay, expressed a pressing need for substantial reform in the business rates system tailored specifically for the hospitality sector. He emphasized, ‘I think we need more fundamental reform of business rates for the hospitality sector to reduce the burden of that particular tax.’ Double's call for reform underscores the recognition of the unique challenges faced by the industry and the necessity for a comprehensive approach to alleviate its financial strain.

Tim Farron

Tim Farron, the Liberal Democrat MP for Westmorland and Lonsdale, articulated his hope for ministerial support that transcends the immediate, foreseeing the potential economic boon associated with backing the hospitality sector.

Farron optimistically stated, ‘I hope ministers would back a sector that will boost our economy to the tune of billions more.’ His sentiments echo the broader perspective of viewing hospitality not just as an immediate concern but as a strategic investment in the nation's economic prosperity.

Rachael Maskell

Rachael Maskell, the Labour MP for York Central, portrayed the hospitality sector as uniquely vulnerable to economic challenges, stating, ‘The hospitality sector is at the sharp end of all markets sensitivities. It feels every economic challenge acutely. The sector needs support.’ Maskell's depiction emphasizes the sector's sensitivity to economic fluctuations and underscores the urgency for targeted support to sustain its crucial role in the overall economic landscape.

Tobias Ellwood

Tobias Ellwood, the Conservative MP for Bournemouth East, issued a direct plea to reconsider the decision to raise VAT to 20%, recognizing the industry's plea for relief. He stated, “My simple, but critical, call to action today is please listen to the hospitality sector, who are screaming out that VAT is too high. Please reconsider the decision to raise VAT to 20%, otherwise you will face ever more business closures and subsequently raise less tax for the Exchequer.”

Ellwood's plea emphasizes the potential repercussions of a high VAT rate, not only for businesses but also for the overall tax revenue, urging a reconsideration of this critical fiscal policy.

Conclusion

With a resounding chorus of bipartisan support, the future of the hospitality sector in the United Kingdom emerges from the shadows of instability, fuelled by the challenges posed by the COVID-19 pandemic and the cost-of-living crisis.

The unified voices of MPs, such as Steve Double, Tim Farron, Rachael Maskell, and Tobias Ellwood, resonate as a beacon of hope for an industry that has weathered unprecedented storms. Their collective commitment to reforming business rates, advocating for economic growth, and re-evaluating the VAT rate signals a pivotal moment in the trajectory of the hospitality sector.

As the nation anticipates the unveiling of Jeremy Hunt's Spring Budget on March 6, 2024, there is an air of optimism that these impassioned calls for support will echo in fiscal policies.

The cross-party backing suggests a shared recognition of the sector's significance and the need for targeted measures to ensure its resilience. Kate Nicholls' leadership in championing UKHospitality’s three-point plan aligns with these collective aspirations, emphasizing the necessity for sustained commitment and action.

In the coming weeks and months, we remain steadfast in tracking the progression of UKHospitality’s objectives as they navigate through the intricacies of parliamentary processes. The hopes are high that Jeremy Hunt's budgetary decisions will mirror the calls made by Kate Nicholls and other like-minded leaders within the hospitality industry.

For those eager to delve deeper into the intricacies of UKHospitality’s three-point plan for the hospitality sector in 2024, a comprehensive exploration awaits at https://www.ukhospitality.org.uk/action-on-growth-investment-and-jobs-critical-in-2024/. In this pivotal moment, as the industry looks toward a more promising future, the collaborative efforts of policymakers and industry advocates set the stage for a revitalized and resilient hospitality landscape in the United Kingdom.

Ready to simplify hospitality ops?

We’ve got you.

Speak with an Opsyte expert to see how we help:

- Save hours on staff scheduling and rota planning

- Automate invoice processing and financial insights

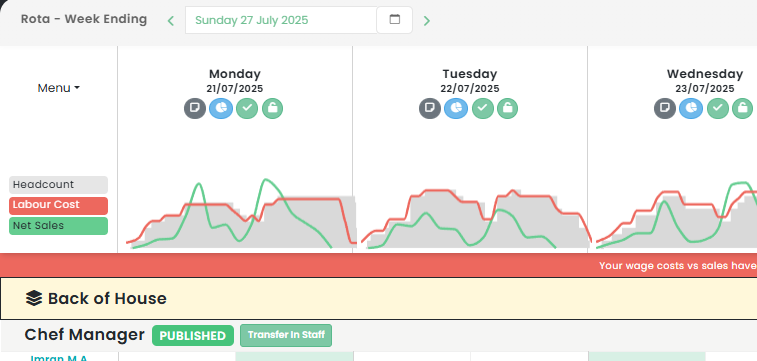

- Track live labour costs vs sales in real-time

- Get fast answers and support from real humans

- Automate your P&Ls

“Opsyte transformed our entire back office. Game changer.”

Read articles from our hospitality experts

-

Maximising Nightlife Entertainment: Innovative Pub Event Ideas and Marketing Strategies for the Hospitality Industry

Revitalise Your Hospitality Business with Creative Pub Event IdeasIn the dynamic and competitive hospitality industry, especially within the sphere of UK pubs, crafting engaging and unique event ideas is crucial…...

-

Boosting Restaurant Productivity: Discover the Best Scheduling Apps and Management Software for the Hospitality Industry

Best Scheduling App for Restaurants: Improving Efficiency in the UK Hospitality IndustryAs we venture deeper into the digital age, the need for efficient and reliable restaurant management software has become…...

-

Maximising Workforce Efficiency: The Ultimate Guide to Rota Software and Shift Planning in Hospitality Management

Revolutionising the Hospitality Industry with Rota SoftwareThe hospitality industry in the UK is a bustling, dynamic environment. To maintain a smooth operation, efficient scheduling solutions, like Rota Software, have become…...

-

Leveraging Hospitality App Development: The Future of Hotel and Restaurant Management in the Mobile Era

Hospitality App Development: A Game Changer for UK Hospitality IndustryIn the dynamic digital landscape, the hospitality industry is continually evolving, and the demand for innovative technology solutions, particularly mobile apps,…...

-

Boosting Employee Satisfaction: The Impact of Implementing a Living Wage in the Hospitality Industry

The Impact of the Living Wage on the UK Hospitality IndustryThe UK hospitality industry has been at the forefront of numerous discussions on wage standards, compensation, and labor rights. One…...

-

Boost Your Bar Sales: Creative Drink Promotions and Marketing Ideas for the Hospitality Industry

Revitalising Hospitality: Innovative Drink Promotions Ideas for SuccessThe UK hospitality sector, with its vibrant nightlife, lively pubs, and eclectic restaurants, thrives on creativity and innovation. One key to success in…...