VAT changes to hospitality - September 2021

Stay informed with industry news, tips, and practical guides for hospitality professionals.

You most probably are aware of the reduction to 5% of specific VAT supplies in the hospitality industry, which the Chancellor introduced on 8th July 2020 to help the sector through COVID.

The Chancellor then extended the 5% VAT until the end of September 2021.

From 1st October 2021 any VAT category benefitting from the 5% will now be replaced with 12.5% VAT until 31st March 2022.

The following supplies, which already currently benefit from the 5% reduced rate, will continue to benefit from the reduced rates through the extension:

- food and non-alcoholic beverages sold for on-premises consumption, for example, in restaurants, cafes and pubs

- hot takeaway food and hot takeaway non-alcoholic beverages

- sleeping accommodation in hotels or similar establishments, holiday accommodation, pitch fees for caravans and tents, and associated facilities

- admissions to the following attractions that are not already eligible for the cultural VAT exemption such as:

- theatres

- circuses

- fairs

- amusement parks

- concerts

- museums

- zoos

- cinemas

- exhibitions

- similar cultural events and facilities

Where admission to these attractions is covered by the existing cultural exemption, the exemption will take precedence.

The types of supplies that the relief applies to will remain unchanged when the new temporary 12.5% rate is introduced on 1 October 2021.

HMRC's website also says: "Further guidance on the operation of the new reduced rate will be published when it comes in to force on 1 October 2021"

Ready to simplify hospitality ops?

We’ve got you.

Speak with an Opsyte expert to see how we help:

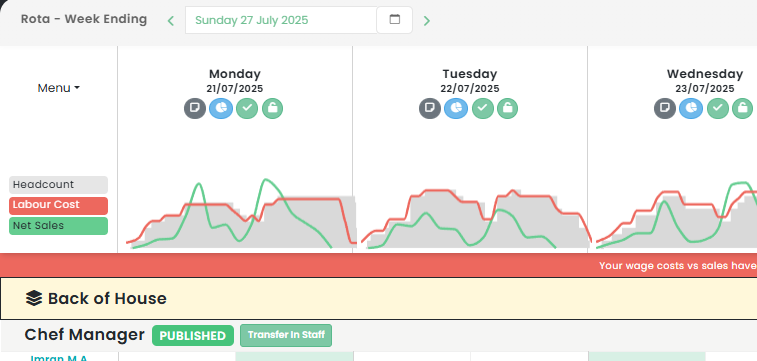

- Save hours on staff scheduling and rota planning

- Automate invoice processing and financial insights

- Track live labour costs vs sales in real-time

- Get fast answers and support from real humans

- Automate your P&Ls

“Opsyte transformed our entire back office. Game changer.”

Read articles from our hospitality experts

-

Maximising Nightlife Entertainment: Innovative Pub Event Ideas and Marketing Strategies for the Hospitality Industry

Revitalise Your Hospitality Business with Creative Pub Event IdeasIn the dynamic and competitive hospitality industry, especially within the sphere of UK pubs, crafting engaging and unique event ideas is crucial…...

-

Boosting Restaurant Productivity: Discover the Best Scheduling Apps and Management Software for the Hospitality Industry

Best Scheduling App for Restaurants: Improving Efficiency in the UK Hospitality IndustryAs we venture deeper into the digital age, the need for efficient and reliable restaurant management software has become…...

-

Maximising Workforce Efficiency: The Ultimate Guide to Rota Software and Shift Planning in Hospitality Management

Revolutionising the Hospitality Industry with Rota SoftwareThe hospitality industry in the UK is a bustling, dynamic environment. To maintain a smooth operation, efficient scheduling solutions, like Rota Software, have become…...

-

Leveraging Hospitality App Development: The Future of Hotel and Restaurant Management in the Mobile Era

Hospitality App Development: A Game Changer for UK Hospitality IndustryIn the dynamic digital landscape, the hospitality industry is continually evolving, and the demand for innovative technology solutions, particularly mobile apps,…...

-

Boosting Employee Satisfaction: The Impact of Implementing a Living Wage in the Hospitality Industry

The Impact of the Living Wage on the UK Hospitality IndustryThe UK hospitality industry has been at the forefront of numerous discussions on wage standards, compensation, and labor rights. One…...

-

Boost Your Bar Sales: Creative Drink Promotions and Marketing Ideas for the Hospitality Industry

Revitalising Hospitality: Innovative Drink Promotions Ideas for SuccessThe UK hospitality sector, with its vibrant nightlife, lively pubs, and eclectic restaurants, thrives on creativity and innovation. One key to success in…...