Mastering Restaurant Accounting: How Opsyte Can Simplify Your Financial Management

Stay informed with industry news, tips, and practical guides for hospitality professionals.

Running a successful restaurant involves a lot more than just providing great food and service. Behind the scenes, efficient financial management is essential for ensuring profitability, compliance, and long-term sustainability. For restaurants, accounting is especially complex, with various factors like inventory, tips, payroll, taxes, and other operational costs to consider.

At Opsyte, we understand the challenges of restaurant accounting and the pressure it puts on managers and business owners. That’s why we offer specialised staff management software designed to streamline your operational processes, so you can focus on delivering exceptional customer experiences while staying on top of your finances.

The Unique Challenges of Restaurant Accounting

Restaurant accounting is a multifaceted task, and understanding its key components is crucial for maintaining a healthy bottom line. Here are some of the primary challenges restaurants face in managing their finances:

1. Payroll Management and Tip Distribution

In the hospitality sector, payroll management goes beyond just salaries. With complex tip distribution systems (like Tronc), overtime rules, and varying wage rates for different roles, calculating payroll accurately can become a nightmare without the right systems in place.

2. Inventory Management

A key aspect of restaurant accounting is keeping track of food costs and inventory. The margins for ingredients and supplies can be tight, and managing stock levels, spoilage, and purchasing at the right price can significantly impact your profitability.

3. Daily Sales Reporting

Restaurants deal with a high volume of transactions each day, from cash tips to credit card payments. Tracking these sales accurately and reconciling them at the end of each day is crucial for ensuring your financial records match your actual revenue.

4. Tax Compliance

The restaurant industry is highly regulated, with tax laws affecting everything from sales tax to employee benefits. Ensuring compliance with tax laws can be time-consuming and complex, but failing to do so can lead to costly fines and penalties.

5. Expense Tracking

With multiple departments, suppliers, and operational costs, tracking all your restaurant’s expenses is a crucial part of your financial health. From utilities to marketing costs and staff training, staying on top of your expenditures ensures you can identify areas for cost-saving and improve your cash flow.

How Opsyte Can Simplify Restaurant Accounting

While Opsyte specialises in staff management software, our platform also provides essential tools that can streamline various aspects of restaurant accounting. Here's how we help businesses like yours:

1. Accurate payroll and tip management

Opsyte’s payroll management system is designed to simplify complex calculations, especially when it comes to tips, overtime, and variable pay rates. Our software integrates seamlessly with your existing payroll system, ensuring accurate and timely calculations for both regular wages and tips. By automating these processes, you can reduce human error, save time, and stay compliant with labour laws.

2. Streamlined Time and Attendance Tracking

Opsyte tracks employee hours automatically, integrating seamlessly with your payroll system. This makes it easier to keep accurate records of worked hours, breaks, and overtime, helping you ensure that your payroll matches actual hours worked without discrepancies. This is particularly important for managing variable shifts, part-time workers, and seasonal staff, all common in the restaurant industry.

3. Data-driven insights for better decision-making

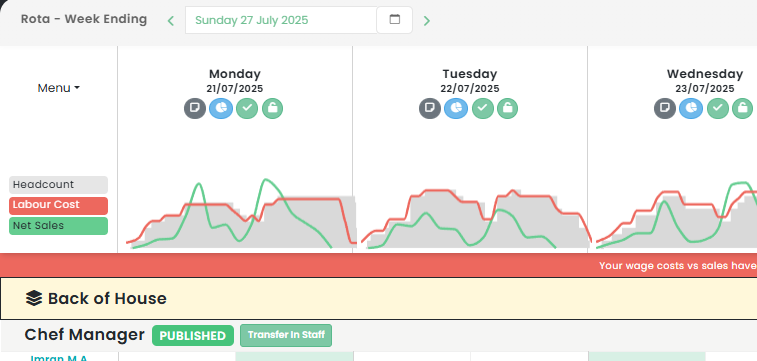

With Opsyte’s reporting tools, restaurant owners and managers can access real-time data on labour costs, sales, and employee performance. This helps you make more informed decisions on scheduling, staffing, and even menu pricing while staying within your budget and improving operational efficiency.

4. Seamless Integration with Accounting Systems

While Opsyte doesn't directly handle your accounting, our software can integrate with popular accounting platforms, allowing for seamless data transfer and reducing the risk of errors. This integration makes it easier to reconcile payroll and sales data with your overall financial records, simplifying your tax preparation process.

5. Cost Control and Labour Optimisation

Our platform helps restaurant managers optimise labour scheduling by analysing patterns in customer traffic and employee performance. By aligning staffing levels with demand, you can reduce unnecessary labour costs without compromising service quality. This leads to better cost control, allowing you to allocate resources more effectively.

Best Practices for Restaurant Accounting

In addition to leveraging software like Opsyte, here are some best practices for managing restaurant accounting effectively:

- Separate Business and Personal Finances

- Ensure your business and personal accounts are separate. This simplifies accounting and ensures that your restaurant’s expenses and income are tracked accurately.

- Track Sales and Expenses Daily

- It’s vital to record and reconcile your daily sales, inventory, and expenses. This will help identify any discrepancies and give you a clear picture of your cash flow.

- Maintain clear record-keeping for tax purposes.

- Keep all receipts, invoices, and payroll records organised and accessible. Having everything in order will help you stay on top of taxes and avoid complications during an audit.

- Monitor your food costs regularly.

- Food costs should be carefully monitored to ensure they stay within a reasonable percentage of your overall revenue. Regularly review inventory, order wisely, and adjust your menu if necessary to improve margins.

- Regularly review financial statements.

- Review your balance sheet, profit and loss statement, and cash flow report at least monthly to identify trends and areas of concern. This will help you make better decisions in the long run.

Conclusion

Restaurant accounting may seem like a daunting task, but with the right tools and practices, it doesn’t have to be. At Opsyte, we specialise in simplifying staff management so that you can focus on running your restaurant and achieving your financial goals. Our platform helps you track employee hours, manage payroll, and optimise staffing, all of which are key components of effective restaurant accounting.

If you’re looking for a way to improve your accounting processes, reduce errors, and streamline payroll management, get in touch with us today. Opsyte can help you take the stress out of staff management and allow you to focus on what matters most: delivering great food and exceptional service.

Ready to simplify hospitality ops?

We’ve got you.

Speak with an Opsyte expert to see how we help:

- Save hours on staff scheduling and rota planning

- Automate invoice processing and financial insights

- Track live labour costs vs sales in real-time

- Get fast answers and support from real humans

- Automate your P&Ls

“Opsyte transformed our entire back office. Game changer.”

Read articles from our hospitality experts

-

Boosting Employee Satisfaction: The Impact of Implementing a Living Wage in the Hospitality Industry

The Impact of the Living Wage on the UK Hospitality IndustryThe UK hospitality industry has been at the forefront of numerous discussions on wage standards, compensation, and labor rights. One…...

-

Boost Your Bar Sales: Creative Drink Promotions and Marketing Ideas for the Hospitality Industry

Revitalising Hospitality: Innovative Drink Promotions Ideas for SuccessThe UK hospitality sector, with its vibrant nightlife, lively pubs, and eclectic restaurants, thrives on creativity and innovation. One key to success in…...

-

Boost Your Bar Business: Innovative Marketing Strategies and Promotion Ideas for the Hospitality Industry

Revolutionising Bar Marketing: Innovative Strategies to Boost Your BusinessIn the bustling landscape of the UK hospitality industry, staying ahead of the competition is pivotal. One sector where this rings particularly…...

-

Maximising Your Profit Margin: Effective Strategies for Increasing Restaurant Profits and Ensuring Financial Success Through Cost Management and Enhanced Operations

Maximising Restaurant Profitability: Strategies for SuccessIn the competitive UK hospitality sector, the ability to increase restaurant profits and maximise restaurant revenue is a critical determinant of success. Many factors contribute…...

-

Leveraging Restaurant Invoice Software: The Ultimate Guide to Streamlining Your Billing and Management Systems

Optimising Hospitality Operations with Restaurant Invoice SoftwareIn the ever-evolving hospitality industry, the need for efficient and effective management systems is paramount. One of the areas that demands meticulous attention is…...

-

Boosting Your Dining Experience: Essential Restaurant Service Tips to Improve Efficiency and Enhance Customer Satisfaction in the Hospitality Industry

How to Improve Restaurant Service: A Comprehensive GuideIn the competitive landscape of the hospitality industry, delivering exceptional restaurant service is of paramount importance. This meticulous attention to service quality not…...