Accounting & Bookkeeping Trends for 2018 and Beyond

Stay informed with industry news, tips, and practical guides for hospitality professionals.

For thousands of years humans have wanted to know what the future has in store. The ancient Greeks had their stories about powerful Oracles that could divine what was to come. Fortunetellers have plied their trade throughout the centuries to kings, noblemen and the common folk alike.

Everyone wants to know what will happen tomorrow and the day after. Bookkeepers and accountants are no different. However, we have a certain advantage most folk don’t have: we use the data and numbers from today to predict what will happen tomorrow. This helps our clients better plan for their growth, or to hunker down and pass through choppy financial waters.

As the year draws to a close, let’s try to augur some of the future from the patterns and trends happening today in cloud accounting, machine learning, multiple generations in the workforce, and the progression of fast-moving technology.

What will 2018 have in store for us?

1. Smarter Software Cloud accounting software, or online accounting/bookkeeping services (whichever term you prefer) are taking hold in our day-to-day workload. Whichever service you use, you are using it to automate tasks, improve your work processes or build better value for your clients and their needs. The latest wave of automation is vast and has the potential to redefine our work lives faster than most people realize. There’s no shortage of dire predictions, like the one that 69 million US jobs are about to be made redundant by smarter software. Even Stephen Hawking has sounded an alarm about paying attention to how smart machine learning is getting. But for every dark prediction there’s one talking about how many new jobs will be created. For bookkeepers and accountants providing a service, you need to take advantage of these new advances and incorporate them into your practice. Your tools are going to only get better and help you achieve more. Five years from today, the average cloud accounting software package will start to resemble a smartphone in number of intuitive features. It will give you a powerful advantage to get more work done and faster than ever.

2. A Deeper Client Partnership The way that bookkeeping and accounting got done a generation ago is nearly over. The software that makes it easier than ever to generate invoices, reconcile statements and download banking transactions are forcing the role of the traditional accountant to evolve. Today and well into the future, the financial expert that can offer strategic personalized advice will be in demand. If you’re providing only a number crunching service, your options will start to shrink. Look for the ways to become more of a strategic partner with your clients. For those of you familiar with the world of websites, a good analogy is the role of a website developer to that of a SEO (search engine optimization) strategist. As website software got better, Wordpress and other web platforms reduced the dependence on needing web developers. At the same time, the importance of having your website appear in search engine results grew. Today, top SEOs are seen as online strategy consultants. In the world of tomorrow, the smart businesses will be the ones using the specialized knowledge base of financial experts to grow their companies. Cultivate those client relationships and the dividends will materialize down the path.

3. The Millennial Workforce Grows Today, one in four workers are in the Millennial Generation. By 2023 it’s expected to be one in two that are Millennials. Using emails to correspond at work is being viewed by Gen Y workers like that old fax machine you got rid of years ago. It’s not that using email is bad, but Millennials grew up using instant messaging and having immediacy in their lives. When they have deep personal experience using a technology that’s worked exceedingly well for them already, why wouldn’t they want to use it to get their jobs done in the best way possible? Look at the latest tools and find ways to try them out in your process. Talk more with clients via IM or chat. Do a quick video call via Skype instead of arranging it on Google Calendar. Using those tools shows that you speak the language of the next workforce, and all those smart CEOs that need your services. When in Rome, do as the Romans do. That’s how you build your personal empire.

4. The Gig Economy Workforce Grows According to this article, in 2016 freelancers made up 34% of the American workforce. By 2020 that same workforce is expected to grow to 43%. These freelancers might be earning all of their living as for-hires, or they are a mixture of full-timers that also work on the side, perhaps for an Uber or AirBnB. They need the service of a dependable professional that can help them keep track of their books, on a part-time basis. They may need to reach you at odd hours. They may need more of your expertise and guidance at the start, but once they know your system, they can move to becoming a dependable, reliable new client. As I mentioned in my last section, court these freelancers by speaking in their language. Seek them out in the online communities that they frequent. Show them how you can be a valuable component to the stability of their business. If this market is expected to grow by several tens of thousands, then you need to be there as well.

5. Cryptocurrency, Bookkeeping & the Farther Out Future With this final prediction I feel like I’m on less certain ground, but it’s a fascinating possibility. Imagine a future, say around 2030, where transactions are done routinely between all companies using a cryptocurrency. If you’ve heard of Bitcoin, then you’ve heard of cryptocurrency. As a brief description, a cryptocurrency allows two strangers to exchange funds (in this case a virtual currency) without knowing their respective identity. A third party, the one that issued the cryptocurrency, knows of the transaction and the ID numbers of the two parties but otherwise they’re as much in the dark as the seller and buyer are. Cryptocurrency allows for what’s being described as a “triple entry bookkeeping” method. Whereas the double entry method has been a dependable staple of bookkeeping for hundreds of years, it’s still prone to the faults of the humans writing down those numbers. Errors can creep in, or even outright deception. When you use a cryptocurrency, every transaction is authenticated, followed, and interlocked. No one can hack into the blockchain, or distributed online ledger, and change the transaction details. If a bookkeeper needs to look at the books, the money trail is clearly marked. Every entry can be traced back to a purchase that’s been authenticated as a receivable good or expense. Triple entry bookkeeping wouldn’t fit the needs of every company and for every transaction, but for companies that want an extra level of security, or the owners/investors that demand more, it supplies greater security. Five trends, four of which I feel are reshaping the accounting and bookkeeping industry right now. What are your thoughts on any one of these five points raised today?

Ready to simplify hospitality ops?

We’ve got you.

Speak with an Opsyte expert to see how we help:

- Save hours on staff scheduling and rota planning

- Automate invoice processing and financial insights

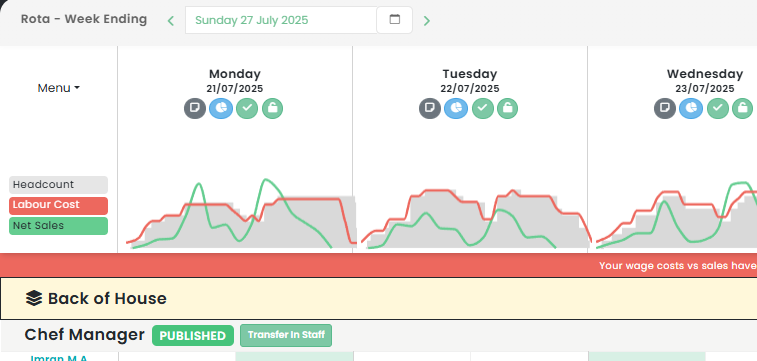

- Track live labour costs vs sales in real-time

- Get fast answers and support from real humans

- Automate your P&Ls

“Opsyte transformed our entire back office. Game changer.”

Read articles from our hospitality experts

-

Leveraging Hospitality App Development: The Future of Hotel and Restaurant Management in the Mobile Era

Hospitality App Development: A Game Changer for UK Hospitality IndustryIn the dynamic digital landscape, the hospitality industry is continually evolving, and the demand for innovative technology solutions, particularly mobile apps,…...

-

Boosting Employee Satisfaction: The Impact of Implementing a Living Wage in the Hospitality Industry

The Impact of the Living Wage on the UK Hospitality IndustryThe UK hospitality industry has been at the forefront of numerous discussions on wage standards, compensation, and labor rights. One…...

-

Boost Your Bar Sales: Creative Drink Promotions and Marketing Ideas for the Hospitality Industry

Revitalising Hospitality: Innovative Drink Promotions Ideas for SuccessThe UK hospitality sector, with its vibrant nightlife, lively pubs, and eclectic restaurants, thrives on creativity and innovation. One key to success in…...

-

Boost Your Bar Business: Innovative Marketing Strategies and Promotion Ideas for the Hospitality Industry

Revolutionising Bar Marketing: Innovative Strategies to Boost Your BusinessIn the bustling landscape of the UK hospitality industry, staying ahead of the competition is pivotal. One sector where this rings particularly…...

-

Maximising Your Profit Margin: Effective Strategies for Increasing Restaurant Profits and Ensuring Financial Success Through Cost Management and Enhanced Operations

Maximising Restaurant Profitability: Strategies for SuccessIn the competitive UK hospitality sector, the ability to increase restaurant profits and maximise restaurant revenue is a critical determinant of success. Many factors contribute…...

-

Leveraging Restaurant Invoice Software: The Ultimate Guide to Streamlining Your Billing and Management Systems

Optimising Hospitality Operations with Restaurant Invoice SoftwareIn the ever-evolving hospitality industry, the need for efficient and effective management systems is paramount. One of the areas that demands meticulous attention is…...