Mastering Restaurant Financial Management: A Comprehensive Guide on Calculating Profit and Loss for Improved Profitability

Stay informed with industry news, tips, and practical guides for hospitality professionals.

How to Calculate Restaurant Profit and Loss

Understanding Restaurant Financial Management

When it comes to restaurant financial management, it's crucial to understand the importance of a profit and loss (P&L) statement. The P&L statement serves as a financial report that provides a summary of a restaurant's revenues, costs, and expenses incurred over a certain period. This document, also known as an income statement, is an integral part of restaurant accounting and an essential tool for managing restaurant finances.

Importance of Restaurant Profit and Loss Statement

A restaurant P&L statement provides a clear picture of the restaurant's profitability. It allows owners and managers to track revenue and expenses, identify trends, and implement changes to improve the business's financial health. Understanding how to calculate restaurant profit and loss is, therefore, key to efficient restaurant financial management.

Calculating Restaurant Revenue

One of the first steps in creating a P&L statement is to calculate restaurant revenue. This is the total amount of money your restaurant has made before any costs or expenses are deducted. It includes income from food and beverage sales, catering services, and any other sources of income.

Understanding Restaurant Expenses

Once revenue has been calculated, the next step is to determine the restaurant's expenses. These can be broken down into two categories: Cost of Goods Sold (COGS) and Operating Expenses. COGS includes the cost of all food and beverage items sold, while Operating Expenses cover all other costs associated with running the business, such as salaries, rent, utilities, and marketing expenses. It's essential to keep a close eye on these expenses as part of your restaurant accounting practices to maintain profitability.

Food Cost Calculation

Food cost calculation is a critical aspect of determining COGS. It involves adding up the cost of food inventory at the start of the period, adding any purchases made, and then subtracting the food inventory at the end of the period. This gives you the total food cost, which is then divided by the total food sales to give a food cost percentage - a crucial metric in the food industry profit calculation.

Calculating Restaurant Profit

Once you have determined your total revenue and total expenses, you can calculate the restaurant profit. This is done by subtracting total expenses from total revenue. The remaining amount is your net profit. Understanding how to calculate restaurant profit is crucial as it helps you gauge the health of your business and identifies areas for improvement.

Improving Restaurant Profits

Calculating profit and loss is not just about keeping track of revenues and expenses; it's also about finding ways to improve your restaurant's profitability. This could mean finding ways to increase restaurant profits, such as introducing new menu items, optimizing staff scheduling, or implementing a marketing strategy. Alternatively, it could involve finding ways to reduce costs, such as negotiating with suppliers or reducing waste. Implementing effective restaurant business tips and strategies can have a significant impact on your bottom line.

Conclusion

Understanding how to calculate restaurant profit and loss is fundamental to successful restaurant financial management. Not only does it provide a clear picture of your business's financial health, but it also enables you to identify opportunities for improving restaurant profits and managing restaurant finances more efficiently. It's a skill that every restaurant owner and manager should master.

Ready to simplify hospitality ops?

We’ve got you.

Speak with an Opsyte expert to see how we help:

- Save hours on staff scheduling and rota planning

- Automate invoice processing and financial insights

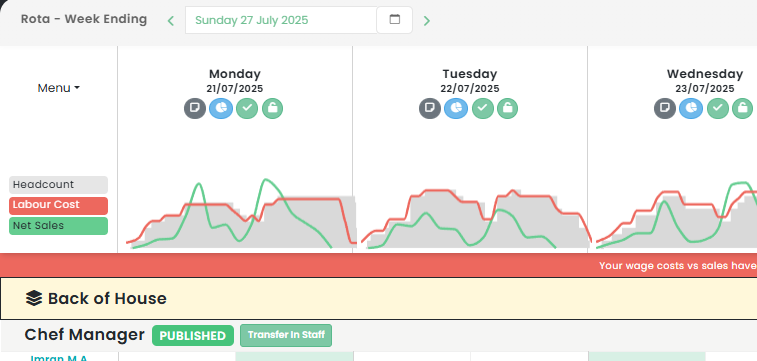

- Track live labour costs vs sales in real-time

- Get fast answers and support from real humans

- Automate your P&Ls

“Opsyte transformed our entire back office. Game changer.”

Read articles from our hospitality experts

-

Leveraging Hospitality App Development: The Future of Hotel and Restaurant Management in the Mobile Era

Hospitality App Development: A Game Changer for UK Hospitality IndustryIn the dynamic digital landscape, the hospitality industry is continually evolving, and the demand for innovative technology solutions, particularly mobile apps,…...

-

Boosting Employee Satisfaction: The Impact of Implementing a Living Wage in the Hospitality Industry

The Impact of the Living Wage on the UK Hospitality IndustryThe UK hospitality industry has been at the forefront of numerous discussions on wage standards, compensation, and labor rights. One…...

-

Boost Your Bar Sales: Creative Drink Promotions and Marketing Ideas for the Hospitality Industry

Revitalising Hospitality: Innovative Drink Promotions Ideas for SuccessThe UK hospitality sector, with its vibrant nightlife, lively pubs, and eclectic restaurants, thrives on creativity and innovation. One key to success in…...

-

Boost Your Bar Business: Innovative Marketing Strategies and Promotion Ideas for the Hospitality Industry

Revolutionising Bar Marketing: Innovative Strategies to Boost Your BusinessIn the bustling landscape of the UK hospitality industry, staying ahead of the competition is pivotal. One sector where this rings particularly…...

-

Maximising Your Profit Margin: Effective Strategies for Increasing Restaurant Profits and Ensuring Financial Success Through Cost Management and Enhanced Operations

Maximising Restaurant Profitability: Strategies for SuccessIn the competitive UK hospitality sector, the ability to increase restaurant profits and maximise restaurant revenue is a critical determinant of success. Many factors contribute…...

-

Leveraging Restaurant Invoice Software: The Ultimate Guide to Streamlining Your Billing and Management Systems

Optimising Hospitality Operations with Restaurant Invoice SoftwareIn the ever-evolving hospitality industry, the need for efficient and effective management systems is paramount. One of the areas that demands meticulous attention is…...