Pros and Cons of Outsourcing Payroll

Stay informed with industry news, tips, and practical guides for hospitality professionals.

Processing payroll is a time-consuming, complex and sometimes laborious task yet is crucial in any business with employees.

Whether you have 2 employees or 95, getting your payroll calculations correct is critical to both your company and your employees. For these reasons a lot of businesses choose to outsource their payroll.

However this decision comes with it’s pros and cons.

Although outsourcing payroll comes as an expense to your business, it can actually be very cost effective and may be able to offer you additional services that save you both time and money. Taking into consideration costs of running payroll software, cost of staff/director time of processing and calculating payroll you could actually end up saving yourself money and allow both yourself and your staff to add value to your business in other areas.

When it comes to payroll, meeting your deadlines is critical. If the person responsible for payroll in your company is not on the ball with when HMRC payments and submissions are due you could land yourself some heavy fines and in hot water with the authorities.

Outsourcing takes away the worry of keeping on track of deadlines.

Having your payroll outsourced means that your PAYE and pension contributions will be calculated correctly. Most people who have processed payroll at some point will understand how complicated calculating tax on pay can be and with the auto-enrolment scheme now in place companies with employees with variable pay and ever-changing eligility for pensions can create a big issue.

A con of outsourcing payroll is primarily, if the information given by the company is incorrect to begin with (i.e. managers haven’t updated rotas correctly) the payroll will be wrong irregardless of who is processing it. In addition, if you have chosen a payroll company who then misses your HMRC deadline/payment the business will still be liable to the fines accrued.

For some types of businesses i.e. the hospitality sector where Tronc schemes/tips are involved the risk of choosing the wrong payroll company could have detrimental effects. Finding a company that understands the tax implications to your business is fundamental to getting your payroll correct so doing thorough research of a prospective company is a must when outsourcing.

Ready to simplify hospitality ops?

We’ve got you.

Speak with an Opsyte expert to see how we help:

- Save hours on staff scheduling and rota planning

- Automate invoice processing and financial insights

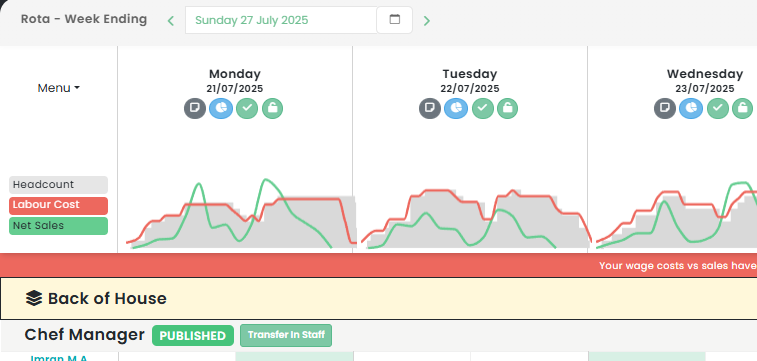

- Track live labour costs vs sales in real-time

- Get fast answers and support from real humans

- Automate your P&Ls

“Opsyte transformed our entire back office. Game changer.”

Read articles from our hospitality experts

-

Leveraging Hospitality App Development: The Future of Hotel and Restaurant Management in the Mobile Era

Hospitality App Development: A Game Changer for UK Hospitality IndustryIn the dynamic digital landscape, the hospitality industry is continually evolving, and the demand for innovative technology solutions, particularly mobile apps,…...

-

Boosting Employee Satisfaction: The Impact of Implementing a Living Wage in the Hospitality Industry

The Impact of the Living Wage on the UK Hospitality IndustryThe UK hospitality industry has been at the forefront of numerous discussions on wage standards, compensation, and labor rights. One…...

-

Boost Your Bar Sales: Creative Drink Promotions and Marketing Ideas for the Hospitality Industry

Revitalising Hospitality: Innovative Drink Promotions Ideas for SuccessThe UK hospitality sector, with its vibrant nightlife, lively pubs, and eclectic restaurants, thrives on creativity and innovation. One key to success in…...

-

Boost Your Bar Business: Innovative Marketing Strategies and Promotion Ideas for the Hospitality Industry

Revolutionising Bar Marketing: Innovative Strategies to Boost Your BusinessIn the bustling landscape of the UK hospitality industry, staying ahead of the competition is pivotal. One sector where this rings particularly…...

-

Maximising Your Profit Margin: Effective Strategies for Increasing Restaurant Profits and Ensuring Financial Success Through Cost Management and Enhanced Operations

Maximising Restaurant Profitability: Strategies for SuccessIn the competitive UK hospitality sector, the ability to increase restaurant profits and maximise restaurant revenue is a critical determinant of success. Many factors contribute…...

-

Leveraging Restaurant Invoice Software: The Ultimate Guide to Streamlining Your Billing and Management Systems

Optimising Hospitality Operations with Restaurant Invoice SoftwareIn the ever-evolving hospitality industry, the need for efficient and effective management systems is paramount. One of the areas that demands meticulous attention is…...