Understanding the Recent Changes to Tronc: What It Means for the Hospitality Industry

Stay informed with industry news, tips, and practical guides for hospitality professionals.

At Opsyte, we understand how vital it is for businesses in the hospitality sector to stay on top of evolving payroll and staff management regulations. As the industry continues to adapt to shifting trends and legislation, one significant change that has been making waves is the evolving role of Tronc.

For those who may not be familiar with it, Tronc is a system that enables businesses in the hospitality industry to distribute tips and service charges to their staff in a tax-efficient manner. Tronc has been widely used for years in restaurants, hotels, and other hospitality establishments, but recent changes have led to important questions for employers and employees alike. Here's what you need to know.

What is Tronc and Why Does It Matter?

Tronc is a special arrangement in the UK where tips, gratuities, and service charges collected from customers are distributed to staff, often outside the usual payroll system. The key benefit is that the system allows employers to manage how tips are distributed and ensures tax efficiency. Typically, a Tronc Master oversees the distribution, ensuring that the system complies with tax regulations and fairness.

The system’s main advantage for employers is that tips paid through a Tronc are not subject to National Insurance contributions (NICs) and are often taxed more favourably. For employees, it provides clarity on how tips are shared and ensures that there is transparency in the distribution process.

What Are the Recent Changes to Tronc?

In recent months, there have been important developments that impact how Tronc systems operate. These changes are designed to create a more transparent and compliant framework for both businesses and staff. The key changes include:

- Increased Scrutiny from HMRC

- The tax authorities have been placing greater emphasis on ensuring that Tronc systems are set up correctly and used transparently. This means that businesses need to ensure that their TRNC arrangements comply with both tax and employment laws. Mistakes in the setup or administration could lead to fines or backdated tax liabilities.

- More detailed record-keeping requirements

- Under the new rules, businesses are now required to maintain more detailed records of how tips are distributed. This includes tracking how much is paid out, to whom, and ensuring that tips are appropriately recorded as part of the employee’s income. For businesses using staff management software like Opsyte, it’s more important than ever to ensure the software provides the tools to track and manage tips accurately.

- Greater focus on fairness and transparency

- One of the aims of the changes is to ensure that tip distribution is transparent and fair. While many businesses in the hospitality sector have already been following good practices, the government is now introducing new guidelines that require employers to make sure tips are shared in a manner that reflects individual performance and fairness. Businesses need to clearly communicate their policies to employees and ensure that the process is open and equitable.

- Inclusion of Digital Payments

- With the rise of digital payments and contactless tipping, there are also changes to how these tips are handled within the Tronc system. Tronc schemes must now account for tips that come from digital sources, which may include apps, online bookings, or card payments. This ensures that no tips are left unaccounted for, and they are properly distributed according to the same rules as cash tips.

What Does This Mean for Hospitality Employers?

As a business owner or manager in the hospitality sector, these changes present a unique opportunity to enhance your payroll practices and improve staff satisfaction. Here’s how:

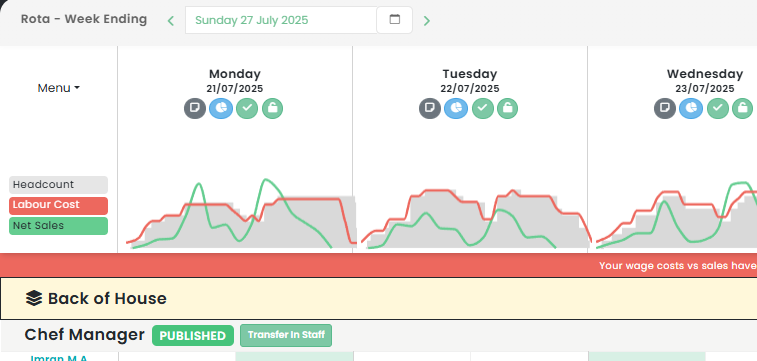

- Adopt Software Solutions Like Opsyte

- While Opsyte does not take direct accountability for the management of the Tronc system itself, our software can still help streamline your overall staff management processes. With our platform, you can accurately track employee working hours, calculate payroll, and manage scheduling in a way that integrates seamlessly with your existing Tronc system. We ensure your staff management is efficient and compliant, allowing you to focus on what matters most: running your business.

- Review Your Tronc System

- It’s essential to review your current Tronc system to ensure it aligns with the latest regulations. If you haven’t already, consult with a professional to ensure that your Tronc setup is robust, transparent, and compliant. This might include revising how tips are divided, ensuring they reflect fair practices, or improving record-keeping systems.

- Communicate changes clearly to staff.

- Transparency is key to maintaining a good relationship with your team. Ensure that your employees fully understand how tips are distributed and how the new rules will affect them. Clear communication will foster trust and help avoid misunderstandings down the line.

Conclusion

The changes to Tronc regulations in the UK are an important reminder for hospitality businesses to stay on top of payroll and employee management practices. While Opsyte does not directly handle the management or accountability of your Tronc system, our platform can assist you with employee time tracking, payroll calculations, and workforce management. This way, you can focus on running your business efficiently while ensuring compliance with the evolving landscape of Tronc regulations.

At Opsyte, we are committed to helping hospitality businesses manage their staff efficiently and stay compliant with the latest laws and regulations. If you need assistance with managing payroll or streamlining your workforce management processes, get in touch with us today to see how our software can make your operations more efficient and compliant.

Ready to simplify hospitality ops?

We’ve got you.

Speak with an Opsyte expert to see how we help:

- Save hours on staff scheduling and rota planning

- Automate invoice processing and financial insights

- Track live labour costs vs sales in real-time

- Get fast answers and support from real humans

- Automate your P&Ls

“Opsyte transformed our entire back office. Game changer.”

Read articles from our hospitality experts

-

Boosting Employee Satisfaction: The Impact of Implementing a Living Wage in the Hospitality Industry

The Impact of the Living Wage on the UK Hospitality IndustryThe UK hospitality industry has been at the forefront of numerous discussions on wage standards, compensation, and labor rights. One…...

-

Boost Your Bar Sales: Creative Drink Promotions and Marketing Ideas for the Hospitality Industry

Revitalising Hospitality: Innovative Drink Promotions Ideas for SuccessThe UK hospitality sector, with its vibrant nightlife, lively pubs, and eclectic restaurants, thrives on creativity and innovation. One key to success in…...

-

Boost Your Bar Business: Innovative Marketing Strategies and Promotion Ideas for the Hospitality Industry

Revolutionising Bar Marketing: Innovative Strategies to Boost Your BusinessIn the bustling landscape of the UK hospitality industry, staying ahead of the competition is pivotal. One sector where this rings particularly…...

-

Maximising Your Profit Margin: Effective Strategies for Increasing Restaurant Profits and Ensuring Financial Success Through Cost Management and Enhanced Operations

Maximising Restaurant Profitability: Strategies for SuccessIn the competitive UK hospitality sector, the ability to increase restaurant profits and maximise restaurant revenue is a critical determinant of success. Many factors contribute…...

-

Leveraging Restaurant Invoice Software: The Ultimate Guide to Streamlining Your Billing and Management Systems

Optimising Hospitality Operations with Restaurant Invoice SoftwareIn the ever-evolving hospitality industry, the need for efficient and effective management systems is paramount. One of the areas that demands meticulous attention is…...

-

Boosting Your Dining Experience: Essential Restaurant Service Tips to Improve Efficiency and Enhance Customer Satisfaction in the Hospitality Industry

How to Improve Restaurant Service: A Comprehensive GuideIn the competitive landscape of the hospitality industry, delivering exceptional restaurant service is of paramount importance. This meticulous attention to service quality not…...